Introduction:

Managing cash flow is crucial for the success of any business. In today’s fast-paced digital world, leveraging technology through apps can significantly ease this process. Let’s delve into the top 5 apps that empower businesses to manage their cash flow effectively.

Mastering Cash Flow with Technology:

In the realm of business operations, cash flow management reigns supreme. It’s the lifeblood of every enterprise, ensuring smooth operations, timely payments, and sustainable growth. However, manual cash flow management can be tedious and error-prone. This is where technology comes to the rescue, offering a plethora of apps designed to streamline financial processes.

Understanding Cash Flow Dynamics:

Cash flow encompasses the movement of money in and out of a business, including revenue generation, expenses, investments, and loans. It’s imperative for businesses to maintain a positive cash flow to meet their financial obligations and seize growth opportunities.

Cash Flow Forecasting: Accurate cash flow forecasting is essential for making informed business decisions. By predicting future cash inflows and outflows, businesses can anticipate financial challenges and plan accordingly, ensuring stability and resilience.

Top 5 Apps for Managing Business Cash Flow:

QuickBooks:

QuickBooks is a versatile accounting software that offers comprehensive cash flow management features. From invoicing and expense tracking to payroll management, QuickBooks simplifies financial tasks for small and medium-sized businesses. Its user-friendly interface and robust reporting capabilities make it a favorite among entrepreneurs.

Engaging Paragraph:

With QuickBooks, you can effortlessly track your income and expenses, categorize transactions, and generate insightful reports to gain a deeper understanding of your financial health. Whether you’re a freelancer, a startup, or an established enterprise, QuickBooks provides the tools you need to stay on top of your cash flow.

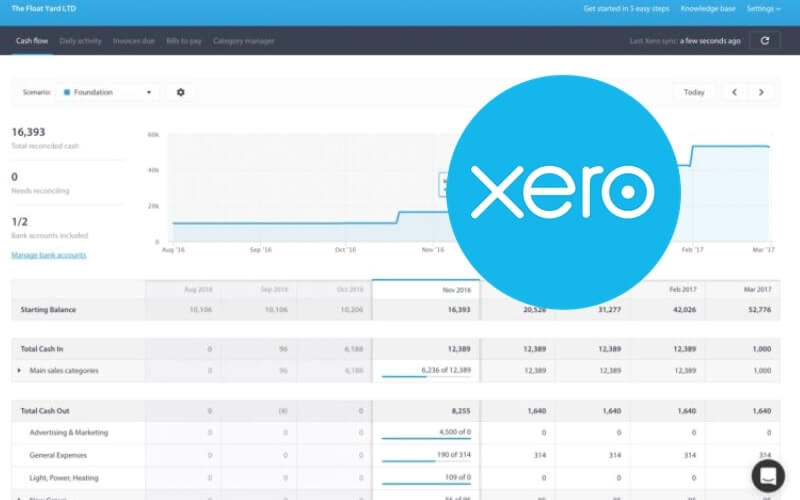

Xero:

Xero is another leading cloud-based accounting software renowned for its intuitive interface and powerful features. Designed for small businesses, Xero offers seamless integration with banks, third-party apps, and accounting professionals, streamlining cash flow management processes.

Engaging Paragraph:

Xero simplifies invoicing, bank reconciliation, and expense tracking, allowing businesses to stay organized and in control of their finances. With real-time updates and customizable dashboards, Xero provides unparalleled visibility into your cash flow, empowering you to make informed decisions with confidence.

FreshBooks:

FreshBooks is a popular accounting software tailored to freelancers and service-based businesses. Its user-friendly platform offers essential features such as invoicing, time tracking, and expense management, helping businesses streamline their financial workflows.

Engaging Paragraph:

FreshBooks simplifies invoicing with customizable templates and automated payment reminders, ensuring prompt payment from clients. Its intuitive dashboard provides a clear overview of your cash flow, enabling you to identify trends, track expenses, and optimize your financial performance effortlessly.

Wave:

Wave is a free accounting software designed for small businesses and entrepreneurs. Despite its affordability, Wave offers robust features for invoicing, accounting, and receipt scanning, making it an ideal choice for budget-conscious professionals.

Engaging Paragraph:

Wave’s intuitive interface and seamless integration with bank accounts and credit cards make it easy to track income and expenses in real-time. With Wave, you can generate professional invoices, reconcile transactions, and monitor your cash flow without breaking the bank.

QuickBooks Online:

QuickBooks Online is the cloud-based counterpart of the desktop version, offering remote access and enhanced collaboration features. With QuickBooks Online, businesses can manage their finances anytime, anywhere, using any device with internet connectivity.

Engaging Paragraph:

QuickBooks Online offers the same robust features as its desktop counterpart, including invoicing, expense tracking, and financial reporting. Its cloud-based nature allows for seamless synchronization across multiple devices, ensuring that your financial data is always up to date and accessible whenever you need it.

FAQs:

How do these apps help in managing business cash flow effectively?

These apps streamline financial tasks such as invoicing, expense tracking, and reporting, providing businesses with real-time insights into their cash flow.

Are these apps suitable for all types of businesses?

Yes, these apps cater to a wide range of businesses, from freelancers and startups to established enterprises, offering scalable solutions to meet diverse needs.

Can I access these apps on mobile devices?

Absolutely! All the mentioned apps offer mobile-friendly versions, allowing you to manage your cash flow on the go, whether you’re using a smartphone or tablet.

Are these apps secure?

Yes, these apps prioritize data security and employ robust encryption measures to protect your financial information from unauthorized access.

Do I need accounting expertise to use these apps?

While accounting knowledge can be beneficial, these apps are designed with user-friendly interfaces and intuitive features, making them accessible to users with varying levels of expertise.

Can I integrate these apps with other business tools?

Certainly! These apps offer seamless integration with a wide range of third-party tools and services, allowing you to customize your financial workflows and enhance productivity.

Conclusion:

In conclusion, effective cash flow management is essential for the success and sustainability of any business. By leveraging the top 5 apps mentioned above, businesses can streamline their financial processes, gain valuable insights, and achieve greater control over their cash flow. Whether you’re a freelancer, a startup, or a growing enterprise, investing in the right tools can make all the difference in optimizing your financial performance and driving long-term success.