Introduction

Planning a wedding is an exciting time, but it can also be a significant financial undertaking. Fortunately, there are various investment strategies that couples can utilize to fund their dream wedding without sacrificing their long-term financial goals. In this article, we’ll explore the top 5 investment strategies for funding a wedding, empowering couples to celebrate their special day while laying the groundwork for a secure financial future.

Exploring Investment Strategies

1. Start a Dedicated Wedding Fund

Creating a dedicated wedding fund is the first step towards financing your special day. Set up a separate savings account specifically earmarked for wedding expenses and contribute to it regularly. Consider automating contributions from your paycheck or setting up recurring transfers to ensure consistent savings over time.

2. Invest in High-Yield Savings Accounts

High-yield savings accounts offer competitive interest rates, allowing your wedding fund to grow faster than traditional savings accounts. Research banks and financial institutions offering high-yield savings options and choose an account that aligns with your financial goals and risk tolerance. Maximize your savings by depositing windfalls or extra income into your high-yield savings account.

3. Explore Low-Risk Investment Options

Consider investing a portion of your wedding fund in low-risk investment vehicles such as certificates of deposit (CDs) or Treasury securities. While these investments offer lower returns compared to stocks or mutual funds, they provide greater stability and capital preservation, making them suitable for short-term savings goals like funding a wedding.

4. Utilize Tax-Advantaged Accounts

Take advantage of tax-advantaged accounts such as Individual Retirement Accounts (IRAs) or 401(k)s to save for your wedding while reducing your tax liability. Contributions to traditional IRAs and 401(k)s are tax-deductible, allowing you to grow your wedding fund on a tax-deferred basis. Keep in mind that early withdrawals from retirement accounts may be subject to penalties, so weigh the pros and cons carefully.

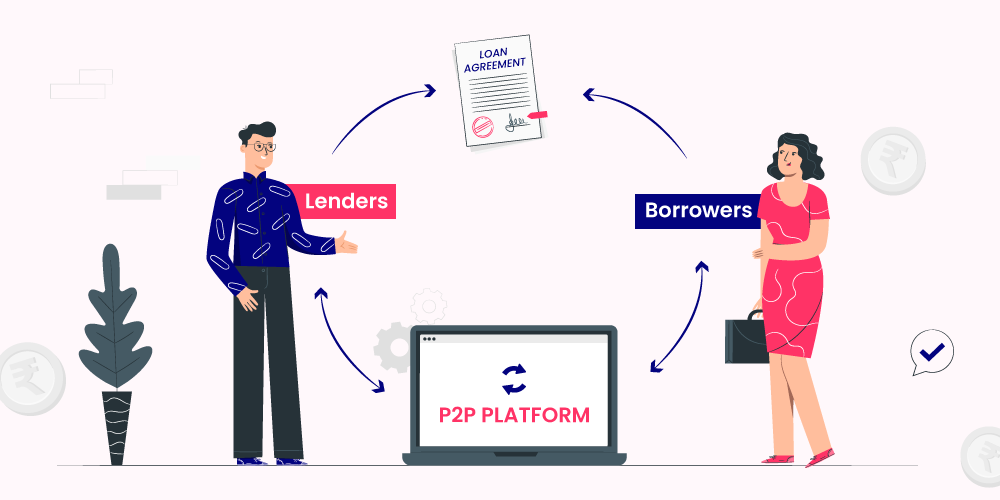

5. Consider Peer-to-Peer Lending

Peer-to-peer lending platforms offer an alternative source of funding for weddings, allowing couples to borrow money from individual investors at competitive interest rates. Explore reputable peer-to-peer lending platforms and compare loan terms and rates to find the best option for financing your wedding. Be sure to factor in loan origination fees and repayment terms when evaluating loan offers.

FAQs (Frequently Asked Questions)

- Is it advisable to take out a loan to finance a wedding? Taking out a loan to finance a wedding should be approached with caution. While it can provide immediate funding for your special day, it may also lead to long-term debt obligations and financial strain. Evaluate your financial situation carefully and consider alternative funding options before resorting to loans.

- How far in advance should we start saving for our wedding? It’s recommended to start saving for your wedding as early as possible to allow ample time to accumulate funds and avoid financial stress. Ideally, begin saving at least a year or two before your planned wedding date to ensure sufficient funds are available.

- Are there any tax implications associated with using investment funds for a wedding? Using investment funds for a wedding may result in capital gains taxes or tax implications depending on the type of investments and withdrawal timing. Consult with a tax advisor to understand the tax consequences and plan accordingly.

- What if we need to adjust our wedding budget due to unforeseen circumstances? Flexibility is key when planning a wedding, and it’s essential to be prepared for unexpected expenses or budget adjustments. Consider establishing a contingency fund or exploring alternative funding sources to cover unforeseen costs without derailing your wedding plans.

- Can we enlist the help of family and friends to contribute to our wedding fund? While it’s common for family and friends to offer financial assistance or contribute to wedding expenses, it’s essential to approach these conversations with sensitivity and tact. Clearly communicate your needs and expectations, and be grateful for any contributions received.

Conclusion

Funding a wedding requires careful planning and financial discipline, but with the right investment strategies, couples can celebrate their special day without compromising their long-term financial goals. By starting a dedicated wedding fund, exploring investment options, and leveraging tax-advantaged accounts, couples can finance their dream wedding while laying the groundwork for a secure and prosperous future together.