The top American insurance companies are important parts of the financial sector and they play a major role in the economy through the management of risks. However, they are engaged in fierce competition against each other for market share in the USA and abroad, and face competition from foreign insurers looking to expand their foothold in their domestic market. Other financial companies, such as banks and financial services companies, also challenge them in their insurance and risk management activities in financial markets.

Though they face stiff competition to provide insurance and risk mitigation products and services to individuals, businesses, and institutions, the most important threat for insurers comes from the disruption of their traditional business by insurance tech startups. These new “InsurTech” companies create new ways for people and companies to hedge, manage and anticipate risks and exposure to various hazards, which can impede the activities of traditional insurance companies. And some of them, among the largest US startups, have already grown to become “unicorns”: startups with a valuation above 1 billion dollars.

Equitable Holdings Insurance

Image credit : Google

Industry: Diversified Insurance

Equitable Holdings, Inc. is an insurance company providing life insurance, annuities, and reinsurance, and also engaged in financial services. Tracing its origins to 1859, Equitable Holdings operates in individual and group retirement, and life insurance products through the Equitable brand, and it is also involved in global investment management and research through its AllianceBernstein subsidiary.

Brown & Brown Insurance

Image credit : Google

Industry: Insurance Brokers

Brown & Brown, Inc., better known as Brown & Brown Insurance or B&B, is an insurance brokerage company. It provides risk management, insurance, and reinsurance products and services to businesses, public agencies, professional and trade organizations, families, and individuals. Founded in 1939, and headquartered in Daytona Beach, Florida, Brown & Brown now provides insurance solutions through more than 300 locations throughout the US.

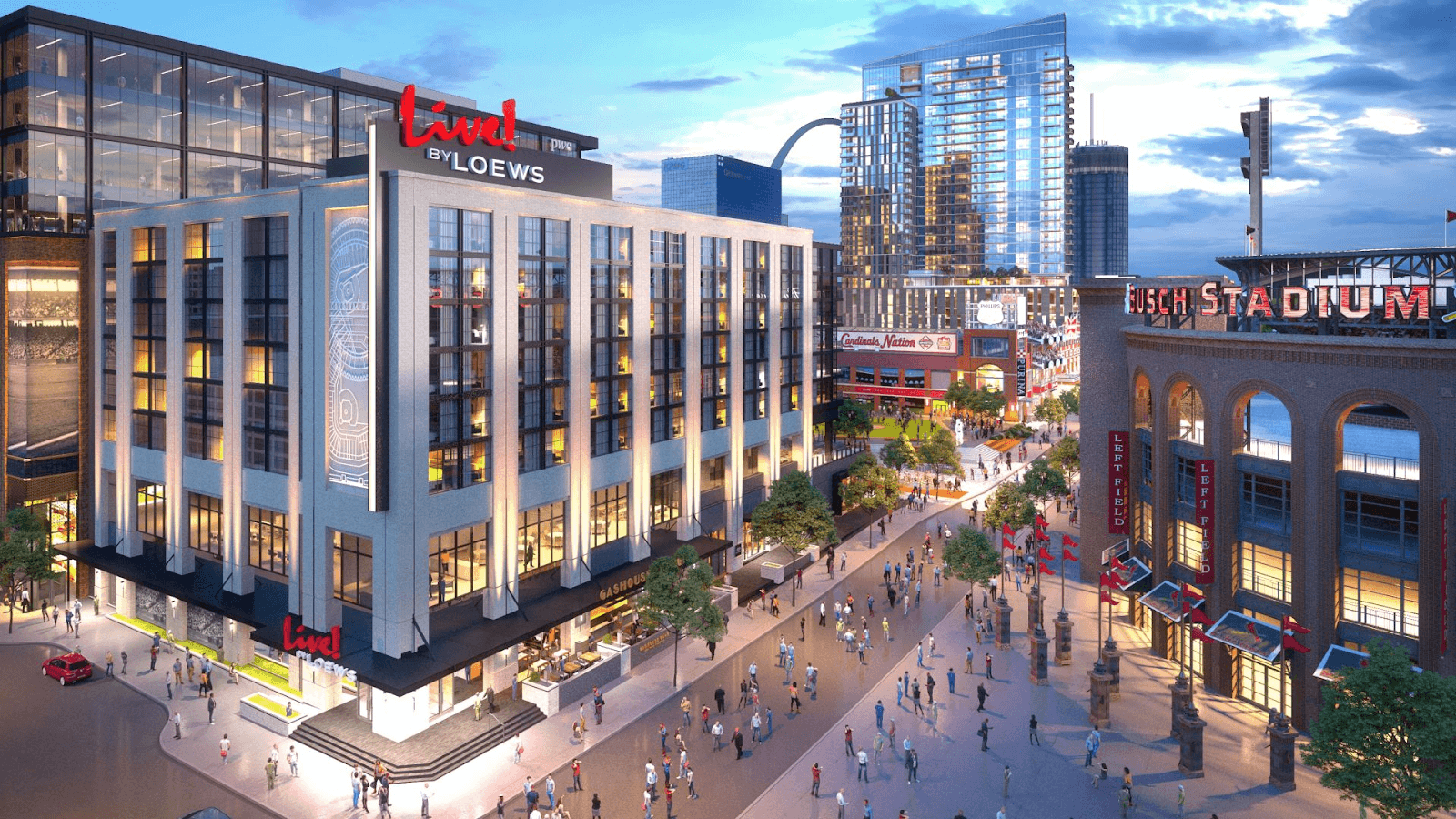

Loews

Image credit : Google

Industry: Property & Casualty Insurance

Loews Corporation is a conglomerate company with majority-stake holdings in CNA Financial Corporation, Diamond Offshore Drilling, Boardwalk Pipeline Partners, Loews Hotels, and Consolidated Container Company. Primarily engaged in insurance through CNA Financial Corporation and its subsidiaries, it provides property and casualty insurance for businesses and professionals in the U.S., Canada, Europe, and Asia.

Prudential Financial

Image credit : Google

Industry: Life Insurance

Prudential Financial, Inc. is engaged in insurance, investment management, and other financial products and services to individual and institutional customers through its subsidiaries. It notably provides life insurance, annuities, mutual funds, pension- and retirement-related investments, administration and asset management, securities brokerage services. Prudential operates in the United States, Asia, Europe, and Latin America

MetLife

Image credit : Google

Industry: Life Insurance

MetLife, Inc. is among the largest global providers of insurance, annuities, and employee benefit programs through its subsidiary Metropolitan Life Insurance Company. Founded in 1968, MetLife operates in home, car, and life insurance, commercial mortgages and securities backed by commercial mortgages, and sovereign debt. It conducts business throughout the United States, Japan, Latin America, Asia Pacific region, Europe, and the Middle East.

Progressive

Image credit : Google

Industry: Property & Casualty Insurance

The Progressive Corporation, more simply known as Progressive, is an insurance company, especially involved in car insurance in America. Founded in 1937 and headquartered in Mayfield Village, Ohio, Progressive offers insurance for motorcycles, boats, RVs, and commercial vehicles, as well as home insurance. It has expanded its offer of car insurance in Australia.

Hartford

Image credit : Google

Industry: Diversified Insurance

The Hartford Financial Services Group, Inc., more simply known as The Hartford, is an investment and insurance company. Founded in 1910 and headquartered in Hartford, Connecticut, the company conducts property and casualty operations, group benefits, and mutual funds, selling its products and services primarily through a network of agents and brokers. It is also involved in auto and home insurance.

Nevertheless, insurance companies are still a pillar of the US economy and they will remain in this position for the foreseeable future. The US is such a great business arena for insurers to prosper that they can use their national foothold to expand abroad and conquer new markets. Whether they provide life and health insurance insurance, property and casualty insurance, insurance brokering services, or reinsurance, insurance companies are in the US to stay, and potentially, also to conquer the rest of the world.

For more information on the largest American companies, download our S&P 500 companies Excel file containing the complete list of the 500 largest publicly listed companies in the US, together with extensive business, market, financial, and digital information on each company. For even more data on the largest US companies, download our Excel files on the Russell 1000 companies, Russell 2000 companies, or Russell 3000 companies.

Read also : 10 Best Life Insurance Companies In USA of 2024

Read also : The 10 Best Mortgage Lenders In Canada For 2024